For the second consecutive year, Portugal is the European country in which companies distribute the best dividends. On average, the dividend yield is 5.36%. Worldwide, only Russia is better.

When it comes to remunerating shareholders, Portugal manages to beat the accomplished achievements on the “pitch” by the selection of the football team. Portugal is the two-time European Champion of the Dividends. For the second consecutive year, Allianz Global Investors puts Portuguese companies on the podium of the best dividends in Europe. Globally it has risen one place, positioned just behind Russia in the remuneration of shareholders.

The Portuguese listed companies have, on average, a dividend yield of 5.36%. This ratio compares how much the company will pay in its dividend with the share price, dividing the dividend by the share price. The higher the rate, the more attractive the dividend.

This percentage is the highest of the last three years (4.4% in 2017 and 4.5% in 2018), and is still well above the average for the Old Continent. “European companies are especially ‘paying (dividend) friends’ by international standards. At the end of 2018, and in the 45 years since 1973, dividend yield on European equities was on average 3.8% across the market, “notes Allianz, noting that this figure compares with 3.2% in North America and 2% in Asia-Pacific.

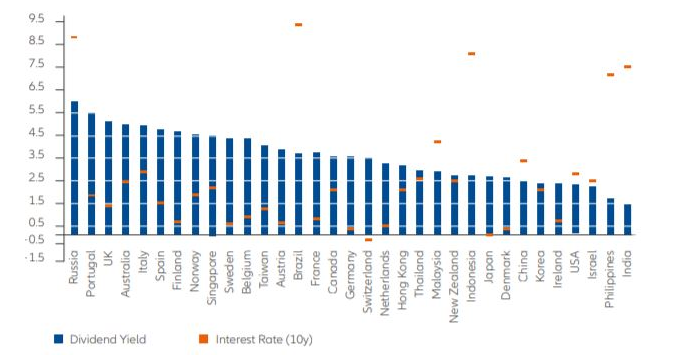

World Dividend Ranking

Within the European area, Portugal is followed by the United Kingdom (4.97%), Italy (4.79%) and Spain (4.65%). The only dividend yield more attractive than that observed in the national market is presented by the Russian listed companies, at around 6%.

At a European level, Allianz anticipates that this year EUR 350 billion in dividends will be distributed, an amount that corresponds to an increase compared to the one observed in recent years. Compared to the remuneration distributed in 2018, it is expected to be around 16 billion euros (an increase of 4.8%).

A growth that Allianz considers to be positive for investor stability vis-à-vis the current policy framework. “In the midst of an uncertain political scenario, dividends seem to continue to be an important stability factor for investors in 2019,” says Allianz, noting that in the last 45 years dividends accounted for about 41% of total share income in European countries.

The asset manager points out that companies that offer more attractive dividends also have a lower level of volatility in their shares. “Stocks with high dividends seem to evolve in a much less volatile way than those with companies with lower dividend payments,” Allianz says.

“Dividend payments operate like an airbag in an investor’s portfolio, which can be particularly advantageous in view of a less favorable market situation. Dividends stabilize the portfolio as they mitigate price adversity and generate predictable returns, “says Hans-Jörg Naumer, director of equity market analysis and co-author of the study, thus highlighting the advantage of betting on higher dividend-yielding securities.